Manipulation of Apple's Stock Price Evident in the Options Market?

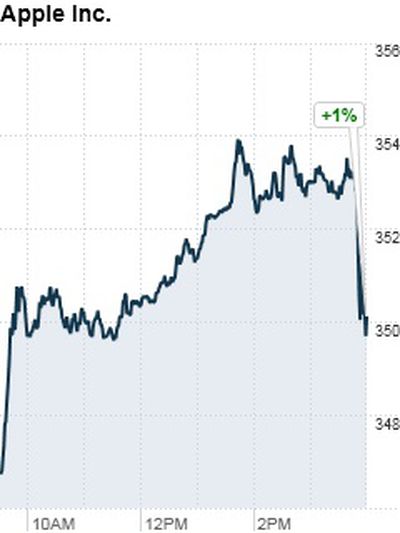

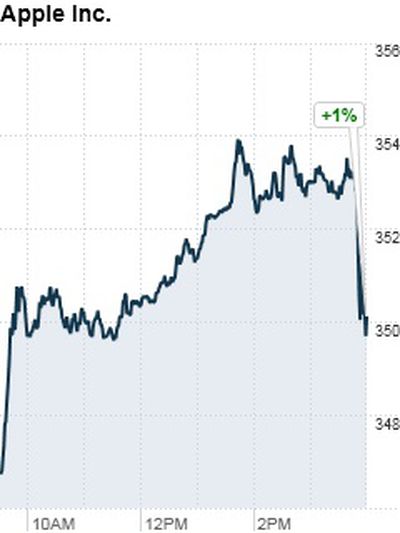

Apple's stock price drop in the closing minutes of trading on April 29th

Fortune reports on an interesting phenomenon being observed in Apple's stock price related to the weekly options market, the trading of rights to purchase stock at a given price at the end of a specified period. According to the report, Apple's stock is consistently seeing suspicious price changes on Fridays as those options are set to expire, activity that makes a significant of traders lose any potential gains as the stock price moves to meet the strike price for that week's options. In many cases, that activity serves to depress the overall stock price, thereby also negatively impacting regular traders as well.

It was 3:48 p.m. on Friday April 29 and traders who had purchased Apple (AAPL) April 29 $350 "calls" -- options that gave them the right to buy Apple shares in blocks of 100 for $350 per share -- were sitting pretty. The stock was trading around $353.50 and those calls were worth more [than] $350 apiece (the difference between the price of the stock and the so-called "strike price" of the option times 100).

Then, in an extraordinary burst of trading -- exacerbated by the rebalancing of the NASDAQ-100 scheduled for the following Monday -- more than 15 million shares changed hands and the stock dropped below the $350 strike price just before the closing bell. Result: The value of those calls disappeared like a puff of smoke.

Fortune went back and charted the daily closing prices for Apple stock over the past eight weeks, comparing the Friday closes to the "max pain" price at which options on both sides of the equation (puts and calls) have the least value in aggregate. Throughout the time period, Apple's stock consistently moved toward the max pain point on each Friday, sometimes over a period of only minutes as trading came to a close for the week.

While the phenomenon is not new and not unique to Apple, the reasons for it are not entirely clear. Some have argued that normal hedging activity is responsible for the drifts in stock price, but scientific studies have shown that such stock price behavior would not be accounted for by simple hedging and is thus indicative of stock price manipulation, which is illegal under U.S. securities law.

Apple is obviously one of the most closely watched stocks these days, and with the second-largest market capitalization in the U.S. markets has the potential to significantly influence trading. And so an apparently consistent manipulation of Apple's stock price makes for an interesting story, even if it is not yet clear who is responsible for the activity and how it is being accomplished.

Popular Stories

Apple's iPhone 17 Pro and iPhone 17 Pro Max models will feature a number of significant display, thermal, and battery improvements, according to new late-stage rumors.

According to the Weibo leaker known as "Instant Digital," the iPhone 17 Pro models will feature displays with higher brightness, making it more suitable for use in direct sunlight for prolonged periods. The iPhone 16 Pro and...

Apple is expected to unveil the iPhone 17 series on Tuesday, September 9, and last-minute rumors about the devices continue to surface.

The latest info comes from a leaker known as Majin Bu, who has shared alleged images of Apple's Clear Case for the iPhone 17 Pro and Pro Max, or at least replicas.

Image Credit: @MajinBuOfficial

The images show three alleged changes compared to Apple's iP...

Apple will launch its new iPhone 17 series this month, and the iPhone 17 Pro models are expected to get a new design for the rear casing and the camera area. But more significant changes to the lineup are not expected until next year, when the iPhone 18 models arrive.

If you're thinking of trading in your iPhone for this year's latest, consider the following features rumored to be coming to...

Just one week before Apple is expected to unveil the iPhone 17 series, an analyst has shared new price estimates for the devices.

Here are J.P. Morgan analyst Samik Chatterjee's price estimates for the iPhone 17 series in the United States, according to 9to5Mac:

Model

Starting Price

Model

Starting Price

Change

iPhone 16

$799

iPhone 17

...

An iPhone 17 announcement is a dead cert for September 2025 – Apple has already sent out invites for an "Awe dropping" event on Tuesday, September 9 at the Apple Park campus in Cupertino, California. The timing follows Apple's trend of introducing new iPhone models annually in the fall.

At the event, Apple is expected to unveil its new-generation iPhone 17, an all-new ultra-thin iPhone 17...

Apple is preparing to release iOS 18.7 for compatible iPhone models, according to evidence of the update in the MacRumors visitor logs.

We expect iOS 18.7 to be released in September, alongside iOS 26. The update will likely include fixes for security vulnerabilities, but little else.

iOS 18.7 will be one of the final updates ever released for the iPhone XS, iPhone XS Max, and iPhone XR,...

A new survey has found that nearly seven in ten iPhone owners in the United States plan to upgrade to an iPhone 17 model, signaling strong demand ahead of Apple's expected unveiling of the devices at its September 9 keynote.

Smartphone price comparison platform SellCell surveyed over 2,000 U.S.-based iPhone users in August to assess upgrade interest and brand loyalty before Apple's event....