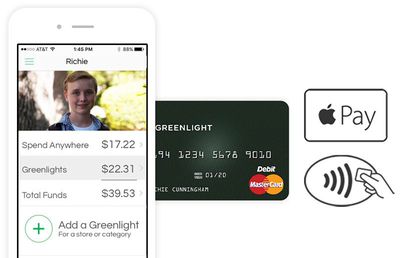

Greenlight today announced that its smart MasterCard debit card for kids now supports Apple Pay and can be used in over 120 countries.

Greenlight is a MasterCard debit card for kids that parents can manage using their smartphones. Parents can top up the card with money instantly, from anywhere, and then specify the exact stores where a child can spend. There's also a Spend Anywhere tab for parents that trust their children's spending habits.

With Apple Pay support, kids no longer have to carry the physical debit card on them, and can simply pay using their iPhone or paired Apple Watch. The card can be set up through the Wallet app on eligible devices.

Every transaction is recorded in the Greenlight app [Direct Link] for iPhone and iPad, and parents receive instant notifications on where and when a child spends, or tries to spend. The card, protected by a PIN number, can be toggled on or off entirely as well, particularly in the event that it's lost or stolen.

For added assurance, Greenlight cards can not be used to withdraw cash at an ATM or get cash back from a purchase. The card also can not be used at any store or website in the categories of wire transfers, money orders, escort services, massage parlors, lotteries, gambling, horse racing, and dog racing.

Greenlight accounts are FDIC insured in the United States through the company's partner Community Federal Savings Bank.

Greenlight costs $4.99 per month, with a free 30-day trial available. Beyond the monthly charge, there are generally no additional fees.

Parents interested in a similar Visa option can look into the recently launched Current smart debit card for kids.