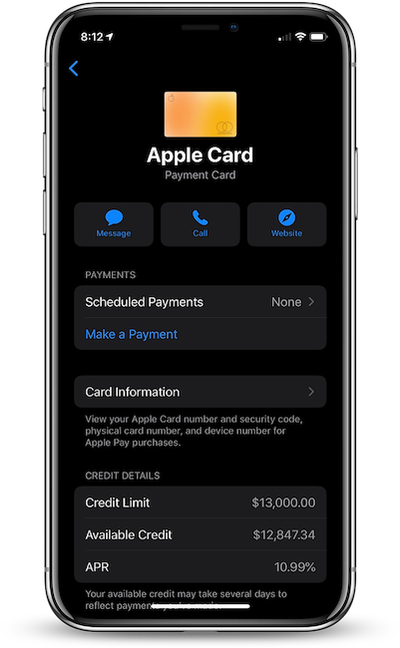

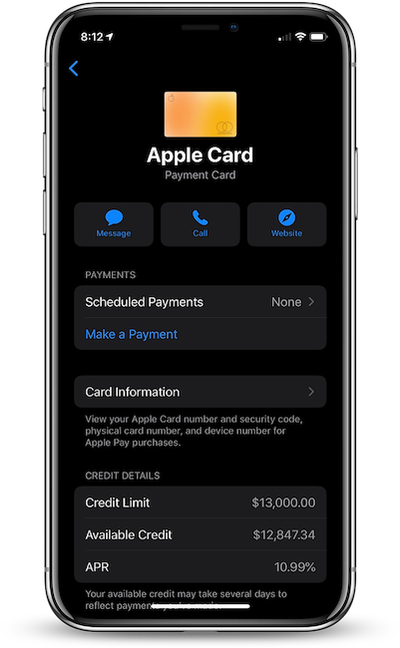

Apple Card's Base APR Lowered to 10.99% for Some Cardholders

Following two interest rate cuts by the U.S. Federal Reserve in March, the Apple Card's base APR has now decreased from 12.49 percent to 10.99 percent for some cardholders, including MacRumors reader Zed and others on Reddit.

This is at least the third time that the Apple Card's APR range has been lowered since the credit card launched in August 2019.

Due to current affairs, Apple recently launched a customer assistance program that allows Apple Card holders to skip their March and April payments without incurring interest charges. To enroll in the program, read Apple's support document.

Key features of the Apple Card include color-coded spending summaries in the Wallet app, no fees beyond any applicable interest, and up to three percent daily cashback.

To apply for an Apple Card, simply open the Wallet app on an iPhone running iOS 12.4 or later, tap the plus button in the top-right corner, and follow the on-screen steps. The process takes just a few minutes, and if approved, your digital Apple Card will be ready for purchases immediately. A physical titanium-based Apple Card is also available for use at retail stores that do not accept contactless payments.

Popular Stories

An iPhone 17 announcement is a dead cert for September 2025 – Apple has already sent out invites for an "Awe dropping" event on Tuesday, September 9 at the Apple Park campus in Cupertino, California. The timing follows Apple's trend of introducing new iPhone models annually in the fall.

At the event, Apple is expected to unveil its new-generation iPhone 17, an all-new ultra-thin iPhone 17...

Apple and Samsung have reportedly issued cease-and-desist notices to Xiaomi in India for an ad campaign that directly compares the rivals' devices to Xiaomi's products. The two companies have threatened the Chinese vendor with legal action, calling the ads "disparaging."

Ads have appeared in local print media and on social media that take pot shots at the competitors' premium offerings. One...

Apple is expected to unveil the iPhone 17 series on Tuesday, September 9, and last-minute rumors about the devices continue to surface.

The latest info comes from a leaker known as Majin Bu, who has shared alleged images of Apple's Clear Case for the iPhone 17 Pro and Pro Max, or at least replicas.

Image Credit: @MajinBuOfficial

The images show three alleged changes compared to Apple's iP...

Following the announcement of Apple's upcoming "Awe dropping" event, on this week's episode of The MacRumors Show we talk through all of the new accessories rumored to debut alongside the iPhone 17 lineup.

Subscribe to The MacRumors Show YouTube channel for more videos

We take a closer look at Apple's invite for "Awe dropping;" the design could hint at the iPhone 17's new thermal system with ...